Bridge | Move Assets Cross-Chain

Swift bridging through Altitude powered cross-chain transfers

Overview

Transfer blue-chip assets 1:1 seamlessly across blockchains.

When a user initiates a transfer, the protocol holds the desired swap amount from the user on the executing chain until the swap has been confirmed on the destination chain. It then gets deposited into the Liquidity Pool of the executing chain. Within two transactions, the protocol calls the LayerZero contract, moving the information of the amount across chains and distributing that amount on the target chain.

The decision to let every transfer consist of two transactions (once on the initiating chain and once on the receiving chain) is to safeguard that there is existing liquidity on the destination chain.

In a balanced liquidity environment, the same amount that is put into the executing chain will be released on the target chain - increasing the liquidity on the executing chain, while reducing liquidity on the target chain.

Example:

✅ Transfer ETH on Ethereum 👉 ETH on Binance Smart Chain

❌ Transfer SOL on Fantom 👉 WBTC on Avalanche

In a scenario where the liquidity on the destination chain has changed during the LayerZero processing so that the swap can not be performed, the user has the option to revoke the swap and reclaim the held funds on the source chain.

What Happens When the Bridge is Used

Bridging is executed through liquidity balances. If a user wants to bridge their tokens from chain A to chain B, they are effectively depositing the desired amount on chain A and withdraw a corresponding amount on chain B. This requires available liquidity on chain B to withdraw from. Altitude's single asset pools represent where users are rewarded ALTD through farming (and share fees through ALTD staking).

Example: User A adds 100 liquidity to Chain A and receives LP tokens on Chain A

Chain A - 100 Liquidity Pool Balance Chain B - 0 Liquidity Pool Balance

Now user bridges from B to A (you can only bridge towards a destination that has sufficient liquidity)

User B "pays" 100 to chain B and "receives" 100 on chain A

Chain A - 0 Liquidity Pool Balance

Chain B - 100 Liquidity Pool Balance

Now, if a user wants to convert LP tokens and withdraw liquidity, they must do this on the chain of the LP token origin (Chain A), unless there is insufficient liquidity.

Because of insufficient liquidity, User A can now withdraw their liquidity cross chain, "burn" their LP tokens on chain A and receive the corresponding tokens back from chain B.

How to Bridge (Transfer) Assets

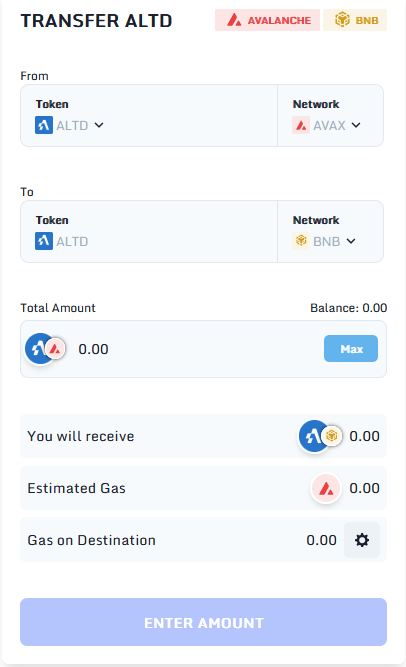

Go to altitudedefi.com/transfer

Connect your wallet.

Connect to MetaMask, Coinbase, or WalletConnect

Select the tokens you wish to transfer, associated networks and amount to transfer

Please make sure your wallet is connected correctly to the ("from network:), otherwise, you'll need to change the network in your wallet settings

Click approve and send tokens

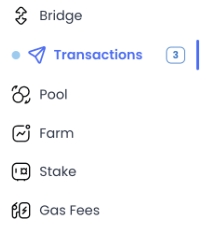

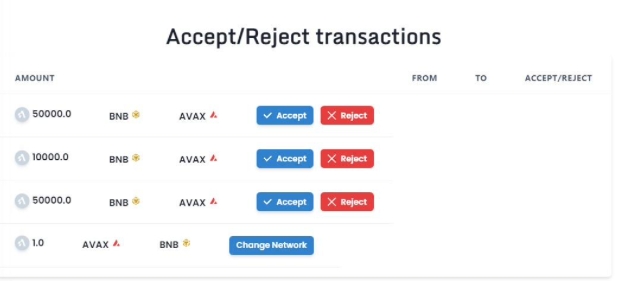

Under "Transactions" you will be able to see your transfers. All non-$ALTD assets need to be confirmed through the transactions page

You will be required to accept transactions upon arrival of your funds on the destination chain. If you choose to revert or cancel the transfer of assets, you can go ahead and reject the transaction.

Fees

Protocol Fee - All non ALTD token transfers incur a 0.025% bridging fee. Collected fees are redistributed to the protocol treasury governed by gALTD holders, where it will be used to buyback and redistribute ALTD.

Rebalancing Fee - When there is an imbalance between Liquidity Pools, a rebalancing fee is taken when transferring from the high liquidity side to the low liquidity side (decreasing liquidity on the low side). That fee gets collected in a reward pool on the low liquidity side and is awarded when transferring from the low liquidity side to the high liquidity side (increasing liquidity on the low side). The greater the imbalance, the greater the fee.

Last updated